by mdibrino@hqmloans.com | May 11, 2023 | Uncategorized

Despite continuing challenge in the housing market, Martell suggested being buoyed by positive trends: “Looking ahead, although the affordability and availability of new and existing homes remains challenging for the industry overall, at loanDepot, we expect to...

by mdibrino@hqmloans.com | May 11, 2023 | Uncategorized

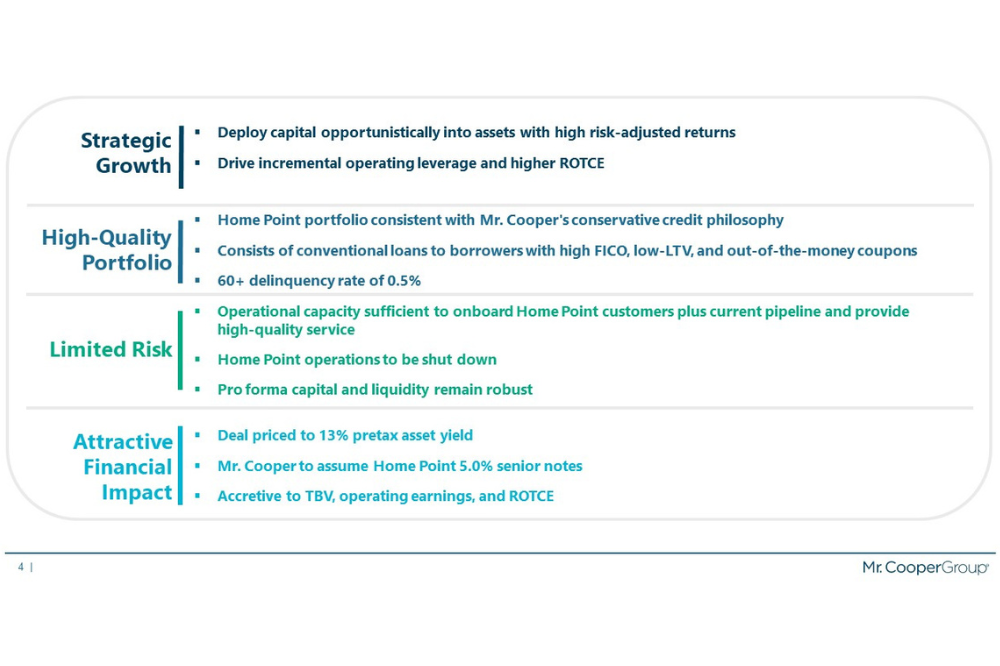

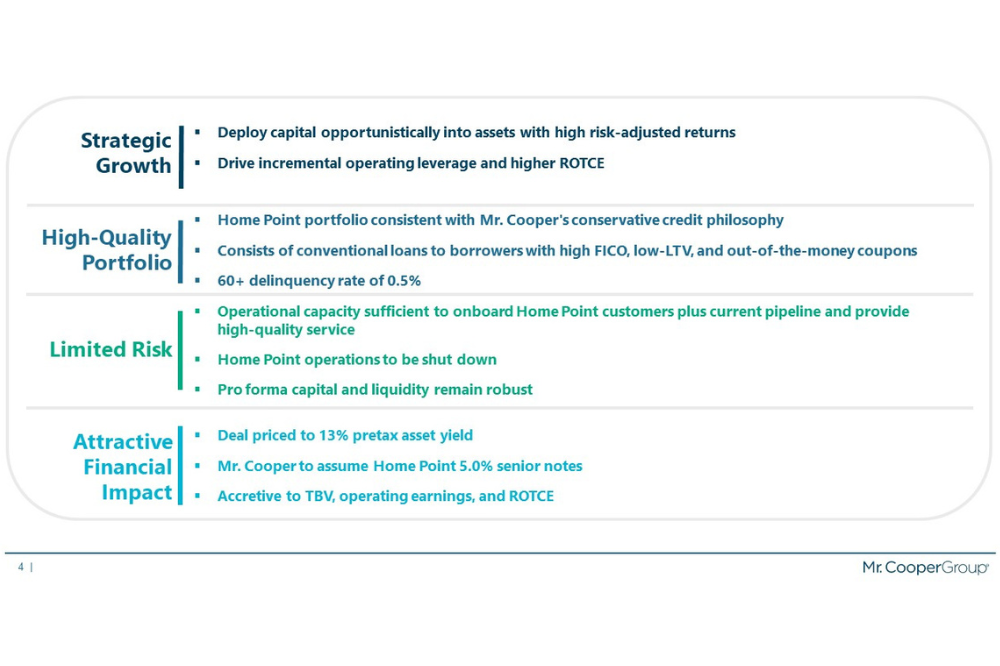

“This acquisition is consistent with our strategy of growing our customer base, deploying our capital with a focus on attractive risk-adjusted returns, and maintaining a very strong balance sheet,” said Jay Bray, chairman and CEO of Mr. Cooper. “Home...

by mdibrino@hqmloans.com | May 11, 2023 | Uncategorized

The next popular strategy with investors is the long-term rental strategy. A slower, more gradual plan in the investment industry, but still very effective. As a landlord, investors can find properties that are ready to go and can start earning rental income as soon...

by mdibrino@hqmloans.com | May 11, 2023 | Uncategorized

The next popular strategy with investors is the long-term rental strategy. A slower, more gradual plan in the investment industry, but still very effective. As a landlord, investors can find properties that are ready to go and can start earning rental income as soon...

by mdibrino@hqmloans.com | May 11, 2023 | Uncategorized

UWM’s total origination volume also fell during the first quarter, down to $22.3 billion from $25.1 billion in the previous quarter. Purchase originations accounted for $19.2 billion – the highest Q1 purchase volume in UWM history, the nonbank noted. On the...

by mdibrino@hqmloans.com | May 11, 2023 | Uncategorized

“Michael is an incredibly valuable part of the Cenlar team,” said Cenlar FSB president and CEO Jim Daras. “His talent and vision for strategically leveraging data will deliver smart, industry-leading business solutions for our clients, their...